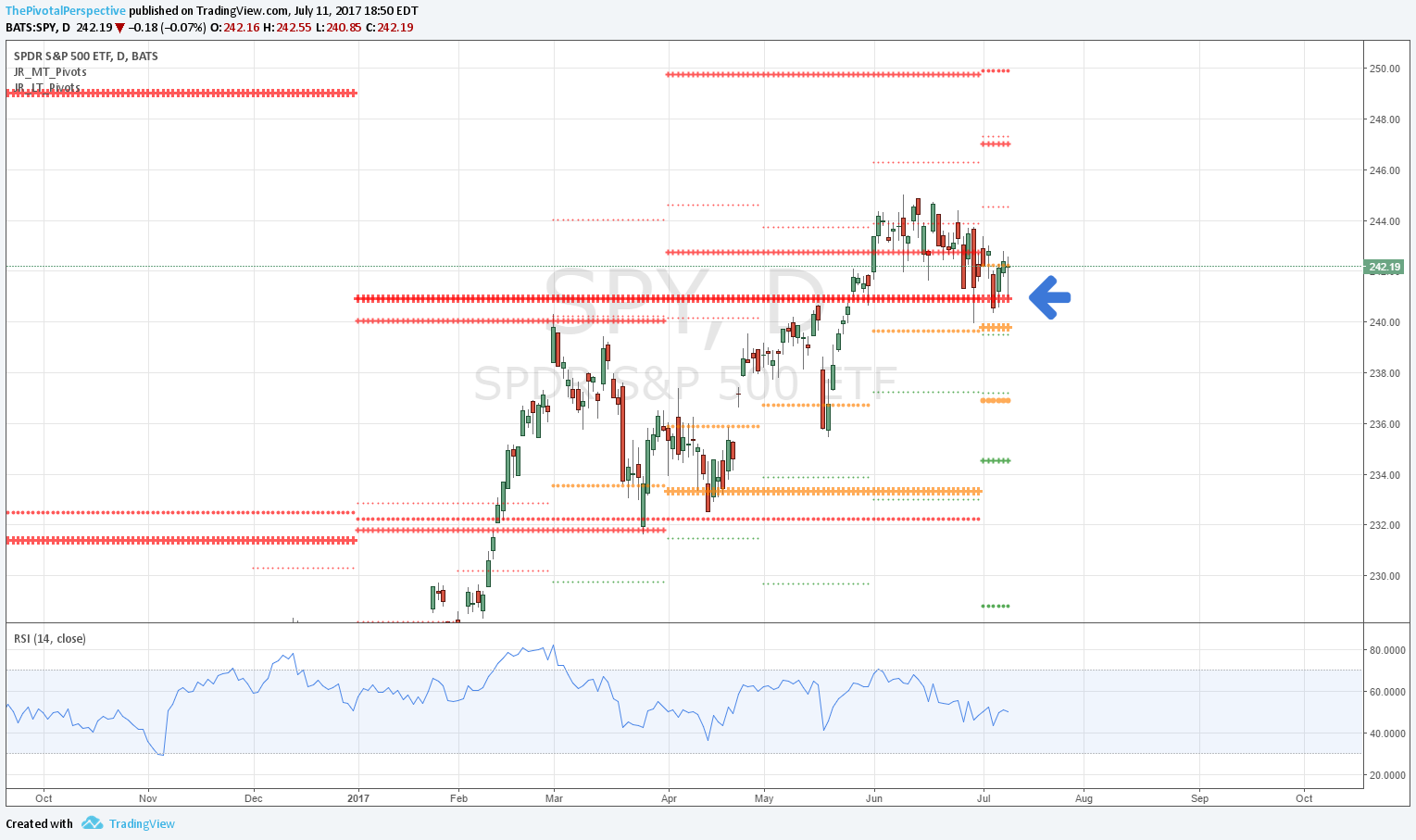

From the latest Total market view: " SPY & DIA should see Q3R1s at minimum." SPY reached the Q3R1 today. DIA is a little shy, but QQQ is at its Q3R1, and VTI almost there too.

It has been many months since I've brought out the TPP top checklist.

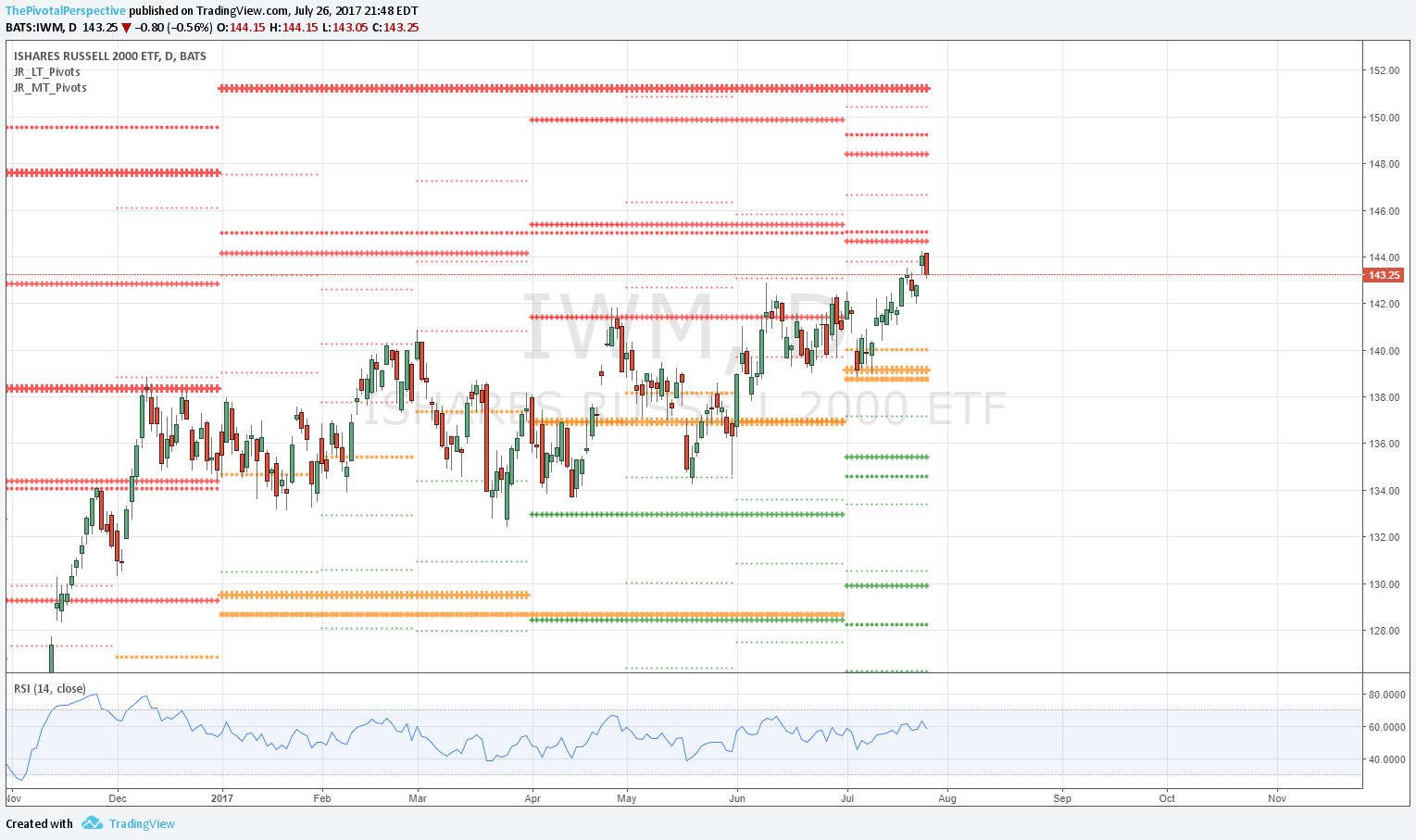

1. Multiple USA main indexes on major pivot level resistance, then rejection?

Two directly on resistance, the others close; no sign of rejection yet.

2. VIX and XIV confirmation?

XIV at level, no rejection yet. VIX very mild divergence.

3. Other technicals like RSI overbought and/or divergence, or higher timeframe issues?

Most RSIs are overbought but no clear divergence yet.

4. High tested with at least one lower high?

Not really. QQQ and IWM fractionally higher today. SPY, DIA and VTI new highs.

5. Safe havens showing concern?

Somewhat, yes. TLT above Q3P for 2 trading days. GLD held Y, then recovered 2HP and D200MA in last several trading days.

6. Breadth or volume divergence?

Not really. Advance decline volume difference on weekly & daily charts both strong. Advance-decline issues doing fine.

7. Sentiment extremes reached?

Yes, on ISEE only - last week and again today. Not yet on AAII, NAIIM or standard CBOE put-call ratios. More than ISEE joining in sentiment extreme would definitely increase chance of a top.

8. Valuation concerns? Fundamentals weaker?

Kinda, but these have been the case for several weeks.

9. Timing?

Possible - 7/21 listed as date from beginning of the month.

10. E-wave idea?

I've thought we were seeing wave 5 subdivision of larger wave 3 earlier, but this still could be in process. When this ends, what is left to move is larger weekly chart wave 4 pullback, then wave 5, then finito!

So while top is possible here due to levels, timing proximity and the high ISEE reading, not a lock yet. What to do? A premature exit can cost - for example, SPY on 2/10 reached Q1R1 / 1HR1 combo, and i was thinking pullback. Instead market zoomed above for a February melt up to a 3/1 high. Check the SPY chart below - basically we are deciding if this week is more likely to make a move like February, or a move like March against the quarterly resistance level. Also note May, that had a very tricky 2 day bear wonder that recovered for a great rally.

Basically we want to see how price reacts to these levels, namely SPY Q3R1 and QQQ Q3R1. Any higher is very bullish. A pause or weak selling is also likely bullish. A full rejection along with VIX / XIV confirming the move, with safe haven strength, is bearish.

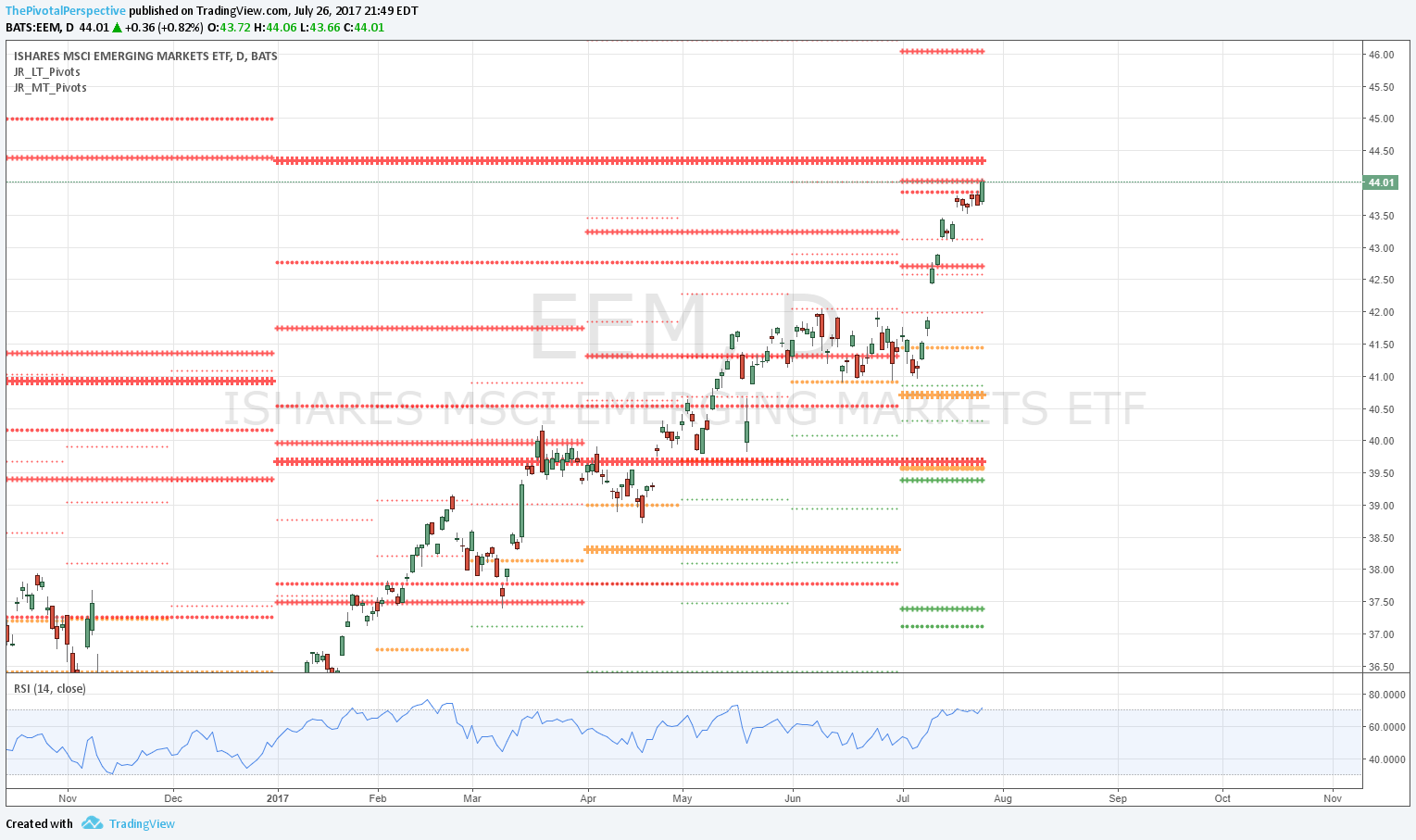

For now with portfolio already benefitting from the 2 GLD longs, I don't think reduction is warranted. If on leverage, it may have been a good place to take that off. The other option is an SPY hedge based on Q3R1. A huge gap up is very unlikely. This is a low cost hedge. I haven't done it yet, but might tomorrow. I am not quite sure how to hedge INDA and EEM. FXI has been stronger of late, which is dangerous; and oil up, which makes EWZ or RSX hedge unwise. May stick with SPY and possibly IWM for USA, and shorts directly on INDA for EEM if wanting to hedge.

SPY, QQQ, INDA and XIV below.