Exciting moves today especially in oil - highlighted in recent Total market view and this week's blog post as "could be worth a significant position" - and financials, "choice for additional longs."

Too bad I only have 10 minutes a day to devote to this project because EURUSD high is bang on YR2 and while I covered the $DXY in a recent post, didn't quite get to that in advance. Quick take - reversal looks for real.

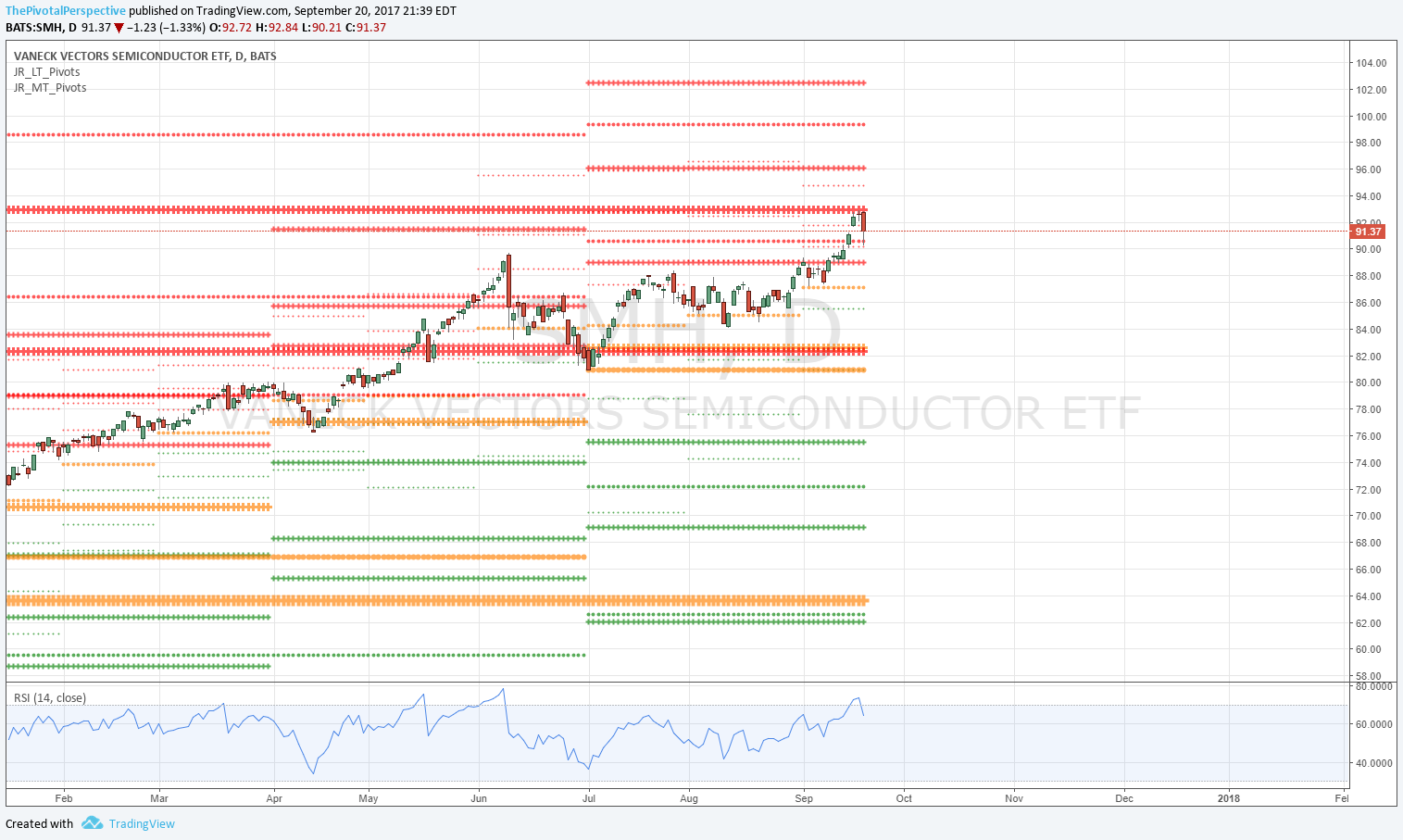

This continues interesting mean reversion with QQQ lower, SMH hit from YR2, EEM & INDA down; yet IWM up, XLF up, DXY up, etc.

With VIX dipping into 9s, XIV at resistance but no move yet; SPX above 2HR1, INDU soaring, XLF strengthening, GLD hammered, so far bulls still have the ball.

SPY, SPX, USO and XLF below.

PS: SMH exit bar today, clear rejection from YR2. This has been on buy list after 8/21 with clear hold of AugP when most other USA mains and sectors had broken.