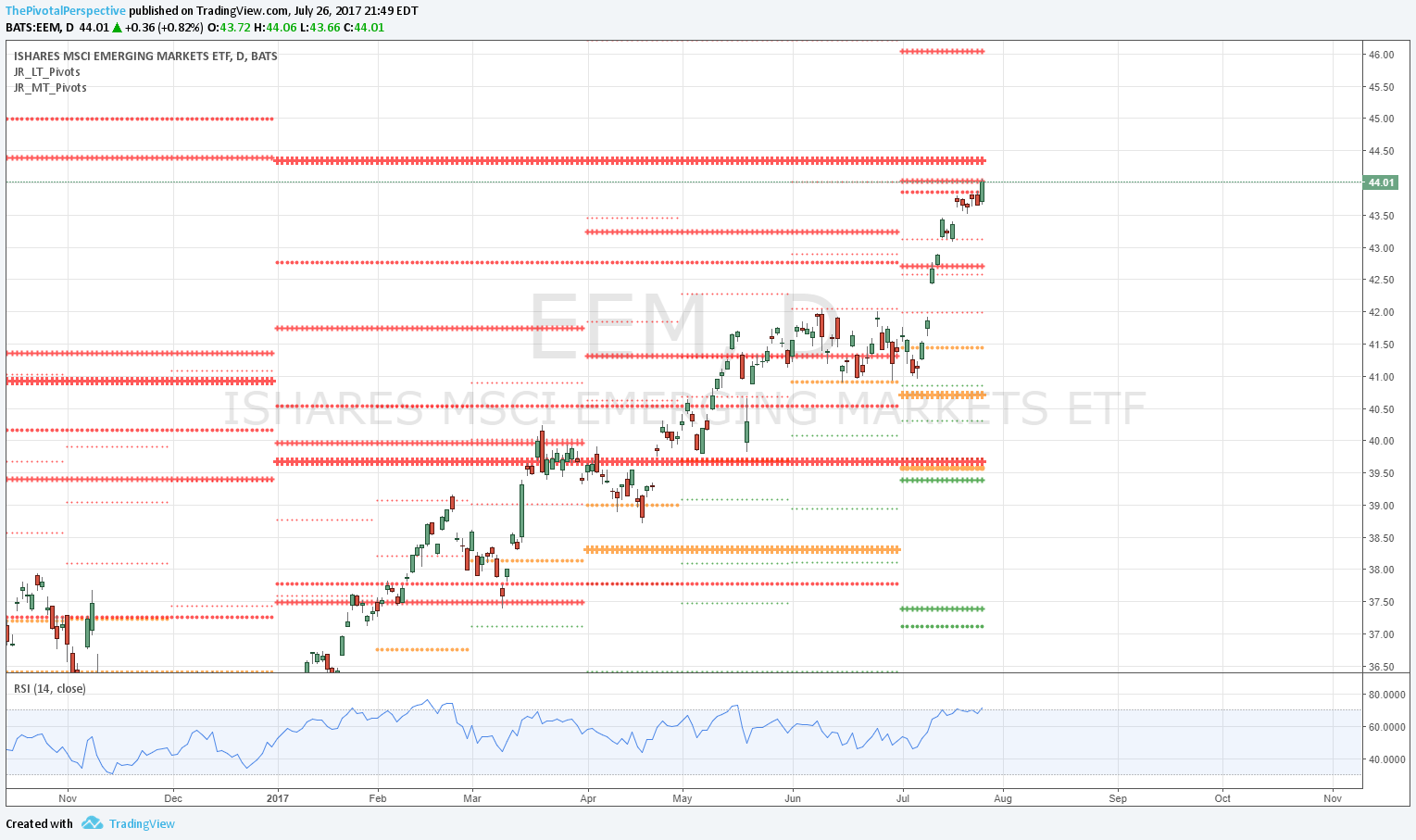

Great day for The Pivotal Perspective - you could say the portfolio is dollar bearish with significant portion in INDA, EEM and GLD.

+s

SPY maintains above Q3R1 and JulR2 for the 2nd day in a row

QQQ also above Q3R1 for the 3rd day, and higher after hours

NYA same, above Q3R1 for the 2nd day

XIV still maintaining above YR3 (barely but still)

?s

DIA testing Q3R1 with near tag

-s

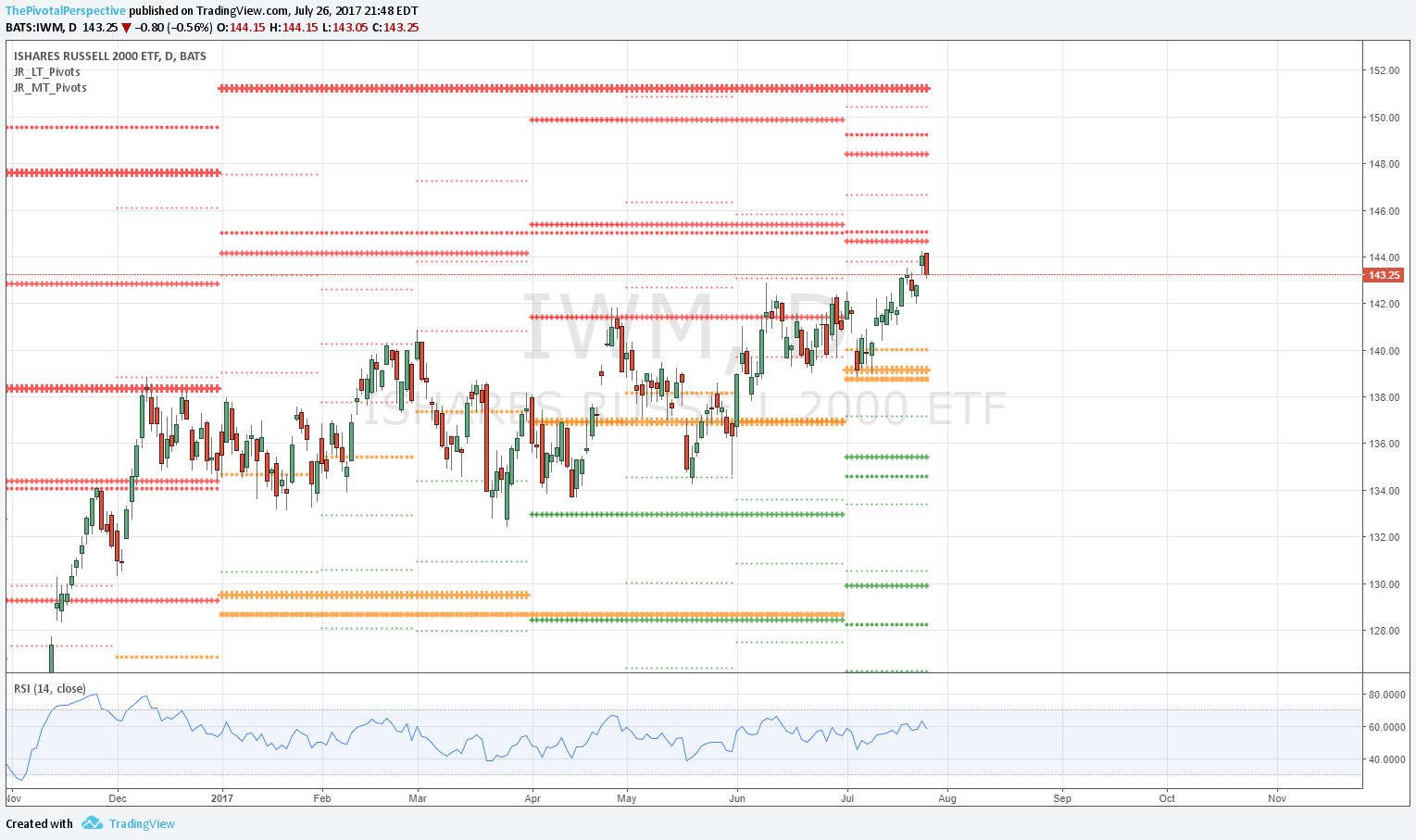

IWM Q3R1 target fail and rejection

VTI Q3R1 slight break

GLD above all pivots!

TLT 2HP hold

VIX reversal bar

So all that is about even. Keep in mind that recent sentiment measures have been extended, and this increases the risk of a slowdown or shakeout. It looks as if Trump trade IWM and XLF will lead the way if that happens.

Adjustments today - out of XLF. It seemed to be perking up end of June as bond rates took off, but it has stalled. Don't like the reaction of high test. Out of SPY hedges taken 7/24 for small loss. Portfolio is still 2 SPY, 2 INDA, 1 QQQ, 1 SMH, 2 EEM, 2 GLD for 100% total exposure and 80% net long. Not sure if correct but going with QQQ for the additional 2 units, valid above the Q3R1.

So still 100% net long stocks, making $ on the GLD position, and keeping a sharp eye on XIV! Also, IWM is now a leading short hedge candidate.

PS: I think VIX may have bottomed today (on the 7/26 timing date FWIW), or near a bottom soon. I don't know if VIX will go lower to its Q3S1 or start moving up from today's low; the corresponding move in XIV would be a rally to its 2HR1, or simply slide under its YR3 tomorrow. But at the same time, even if today was the VIX low & XIV high, I don't think those betting for a huge move in VIX via calls in the near term will make much money. This has been a massive trend with smart $ players, and they should distribute first. This would mean a subdued period of higher lows in VIX as stocks go higher. Then, possibly in a few weeks or months, a real move higher in VIX. I still will be watching UVXY and perhaps VIX calls for opportunities.

SPY, QQQ, IWM, XLF, INDA, EEM, GLD, VIX and XIV below.