VIX and XIV had it right again. Well, i lost some on SPY, IWM and EWZ short hedges, but gained on FXI short and biggest hedge position TLT still gained on the day (though reduced on close). Cut SMH short hedge for a still very successful trade, and cut FXI short (originally a hedge from November) as well, also a decent gain. These were due to market environment and look of weekly charts.

By the way, if i call something a short hedge that means it is offsetting a correlated long. If it is just a short then it is a position without a long against.

Not sure what is happening from here - despite the bull party there are a few indexes bang on key resistance so i opted to close out a lot of positions and as usual sort out things over the weekend.

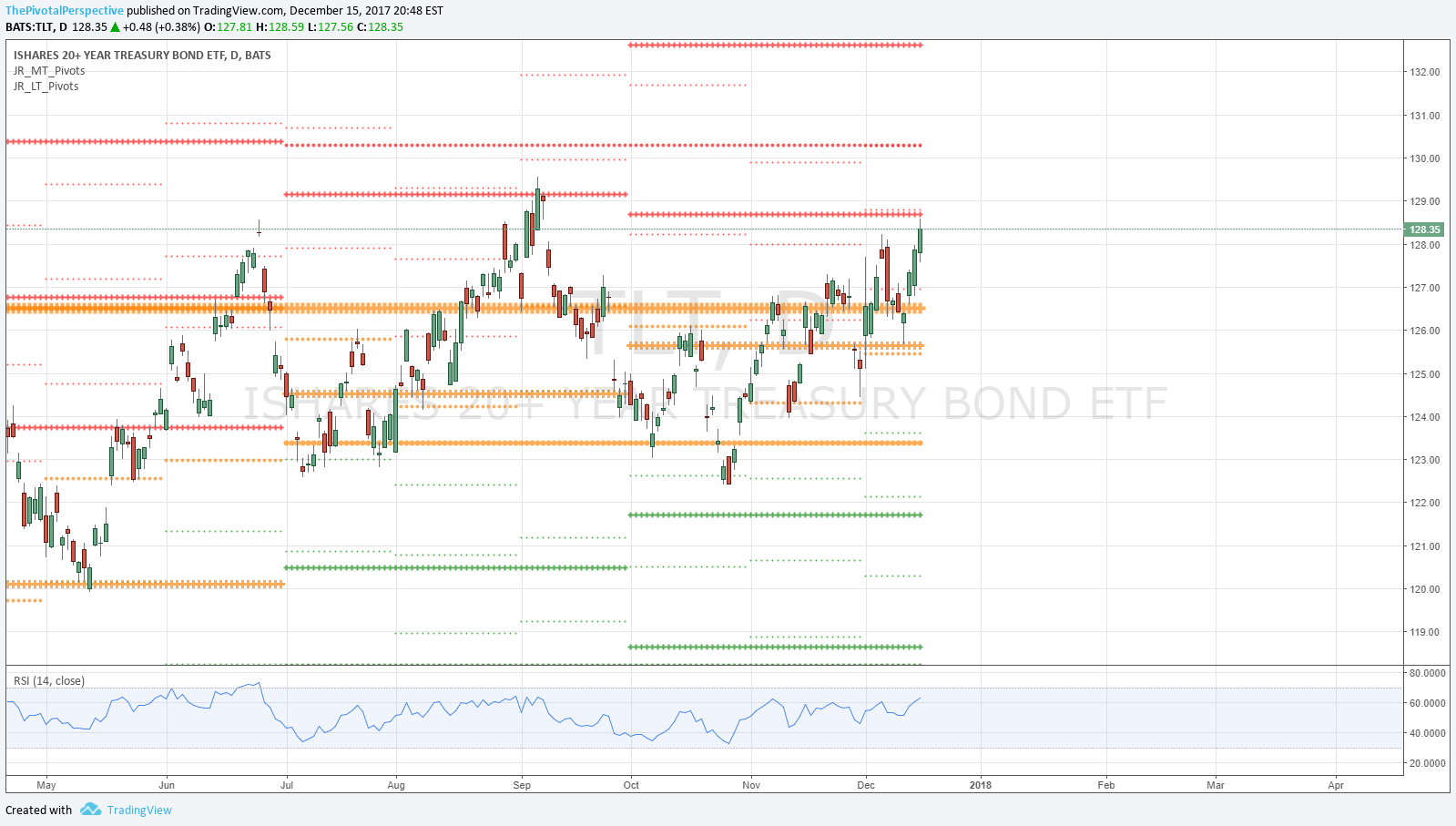

SPX and TLT below.