As we get deeper into 2017 Q4, I am becoming more and more pleased with the call I made about 10 months ago in December 2016:

"...maybe China tech will takeover as a sector-like leader. This is pure theory at this point, since some key China tech names have weaker pivot status than QQQ. Because we should compare apples to apples, let's stick to ETFs instead of stocks. The highest volume is KWEB and it has the big names: Alibaba, Tencent, Baidu, etc. Repeat, not a trade rec, this is larger view idea for a theme we may see in 2017."

Yup! Caveat - portions of the original post were not right because I was also thinking that tech a la QQQ would get laggy at the time. This was when QQQ was still below its 2000 top. After it cleared that level, I changed my mind :)

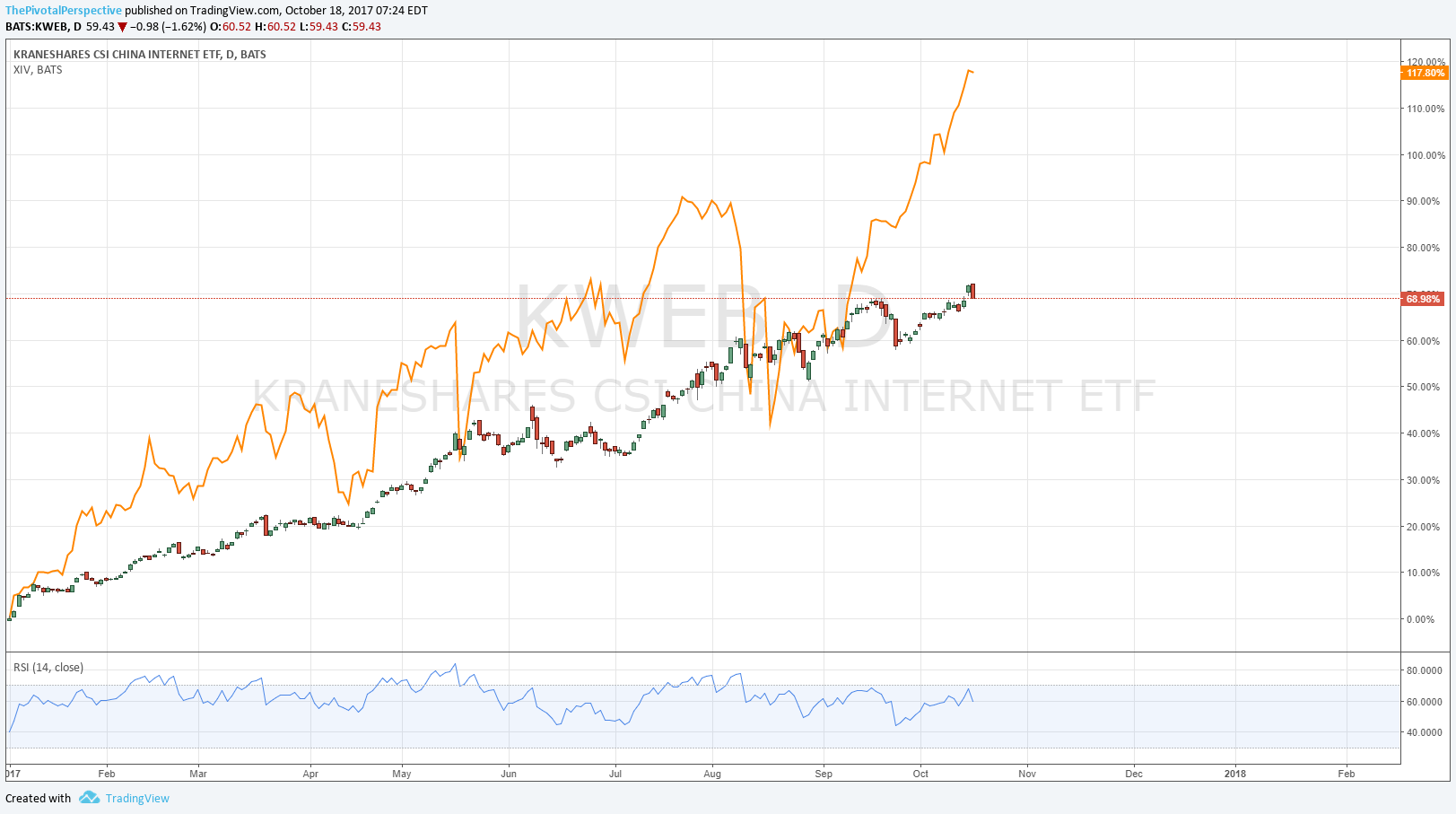

But really, long China tech was *almost* the best move of the year. The only other thing that I could have said to beat it would have been something like "Everyone thinks Trump will be high volatility, so just put everything into short vol and that will win big." That would have been genious, but I didn't quite get there.

China tech has been the second best trade of 2017 - not too bad. And a lot less drawdown than the -26% shocker in XIV (which I nailed too btw).

This sort from ETFDB takes out leveraged vehicles; sorted by YTD %.

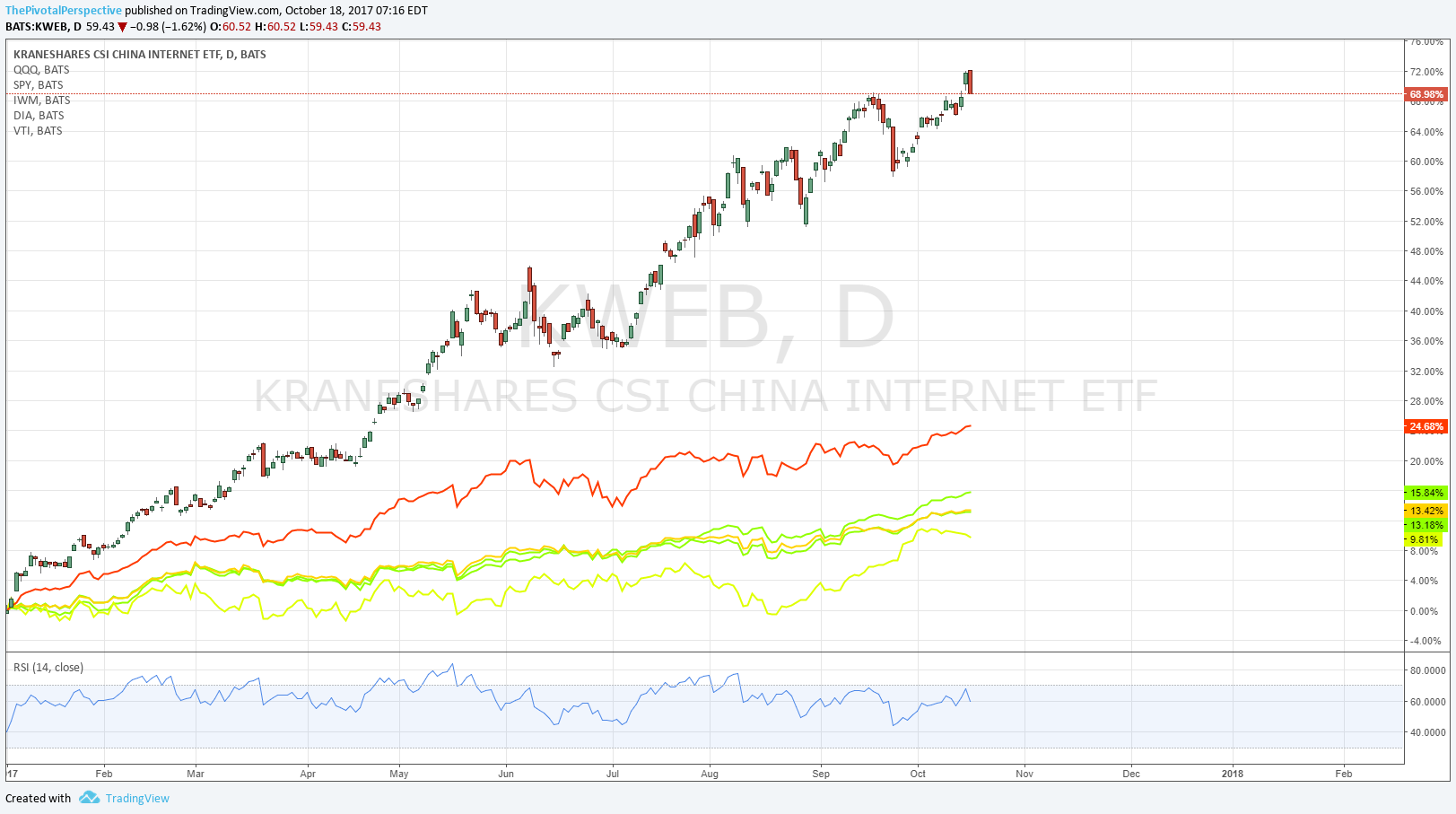

Chart below of KWEB with data of comment "maybe China tech will take over as sector like leader" with QQQ in red, dated from 2016 Q4.

Now for the truly dedicated readers - WHY did i make this call? There was not much in charts at the time.

1. Sentiment seemed quite bearish on China, and SHComp already had dropped -49% and was acting more stable. Keep in mind that 2008 was only -57% absolute high to low; so what people were expecting significant downside after -49% already done seemed rather absurd.

2. I thought given multiples that smart money would start to allocate outside of USA - correct, big time, not just in China tech. It just so happened that China tech benefitted the most from this movement.

3. Esoteric / proprietary time cycle analysis. Searching timing for more of this aspect of my work.

A few more charts:

KWEB vs USA main indexes - SPY QQQ DIA IWM VTI.

KWEB vs sectors - XBI SMH XLF XLE

XBI & SMH both having great years too.

KWEB vs other developed, in $USD - EFA EWG EWJ

KWEB vs other emerging - FXI EEM ASHR (ETF for Shanghai Comp) INDA EWZ

And now to the short vol XIV, one of the few things to be beat KWEB but with lot more volatlity.