Sum

Safe havens showing some caution for stocks. VIX is below all pivots but rebounding up from Q2S1 on a 5/8-10 area turn. XIV not showing any trouble at MayR1 though, and if higher watch 1HR3 / Q2R2 resistance.

TLT & AGG, and GLD & GDX, all held or recovered levels last week. Strength in safe havens increases the chances of a bearish scenario playing out for stocks. Safe havens breaking levels would give stocks all clear to push higher.

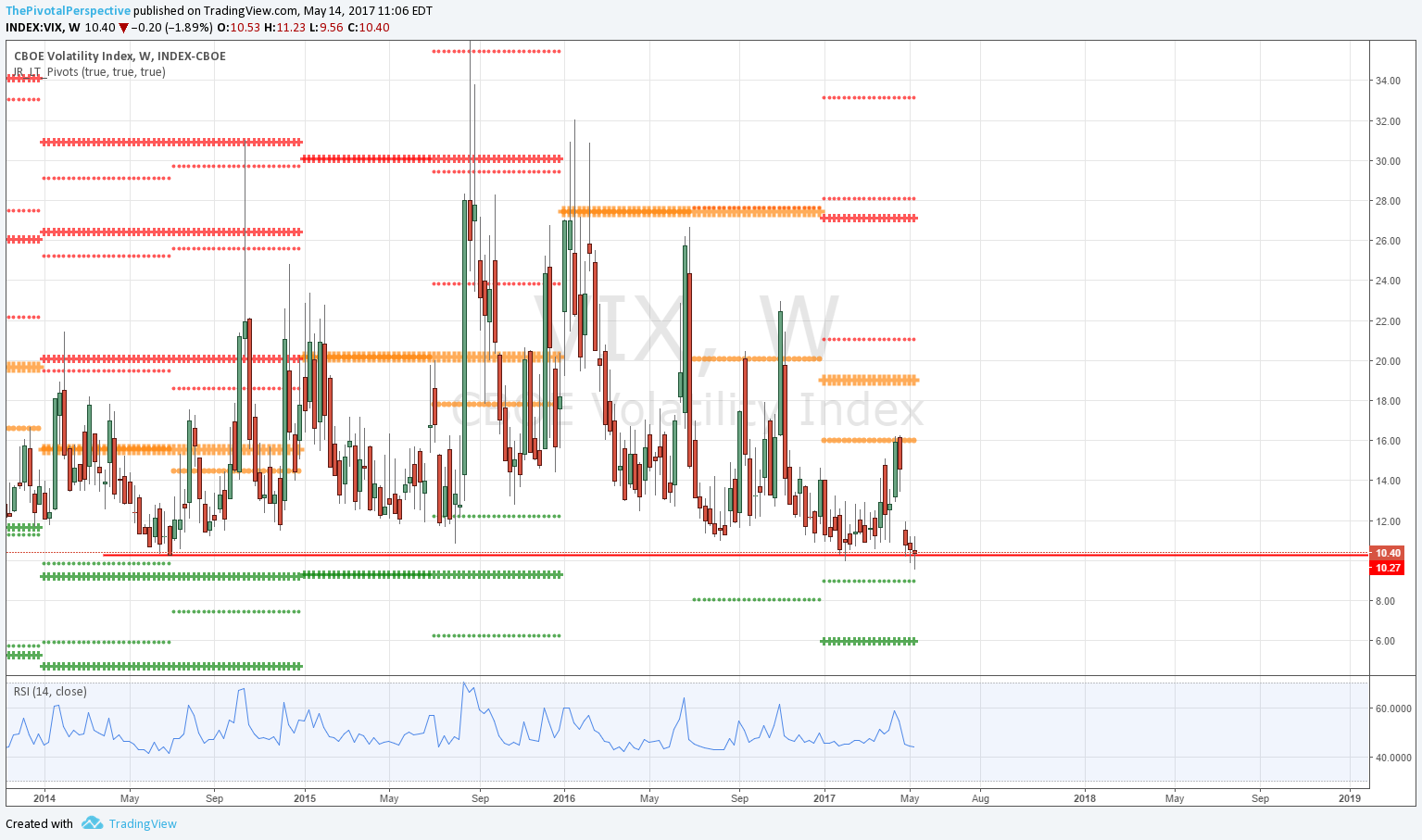

VIX

Weekly chart slightly above the 2014 close low.

Daily chart below all pivots, but rebounding from Q2S1.

Another great job on stock buys 4/17 & 4/24, just choice of vehicle mattered.

VIX sum - below all pivots, but currently rebounding from Q2S1 test 5/8-10 increases the chances of a stock turn.

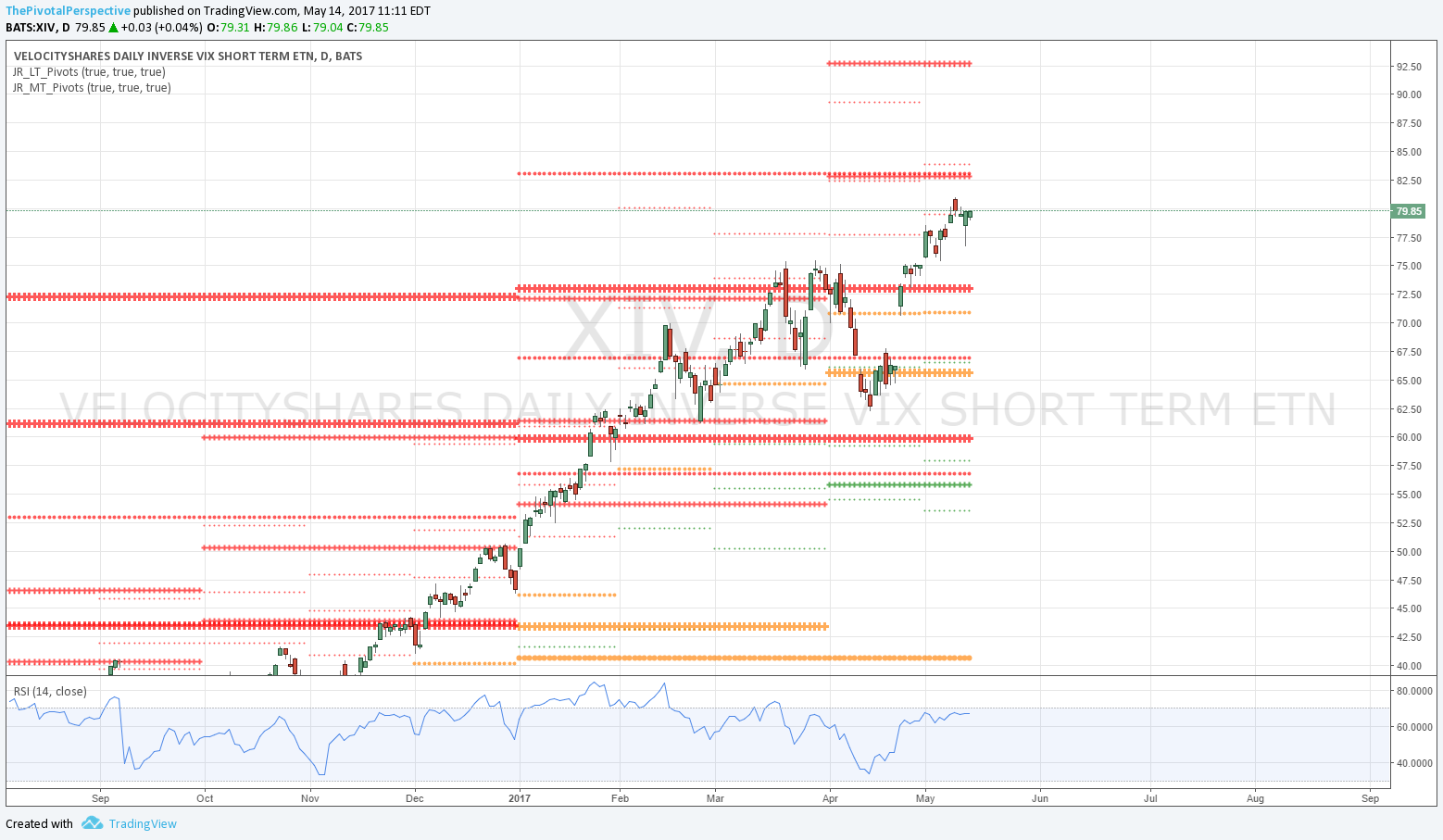

XIV

No problems here, though RSI divergence clear.

XIV at MayR1, if higher 1HR3 and Q2R2 combo will be next area to watch.

XIV at MayR1 but so far no damage. RSI divergence on W and D charts but so far holding up well.

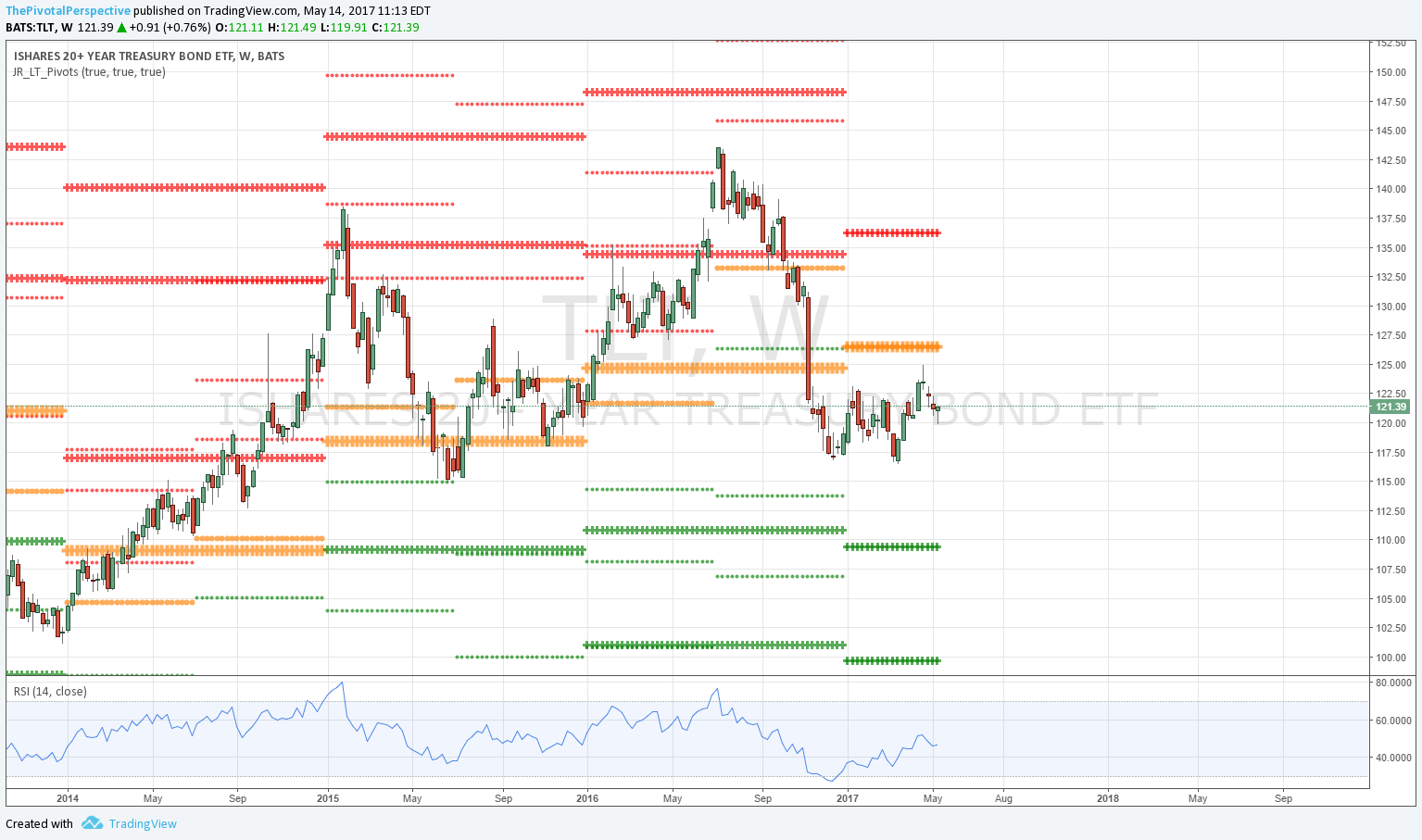

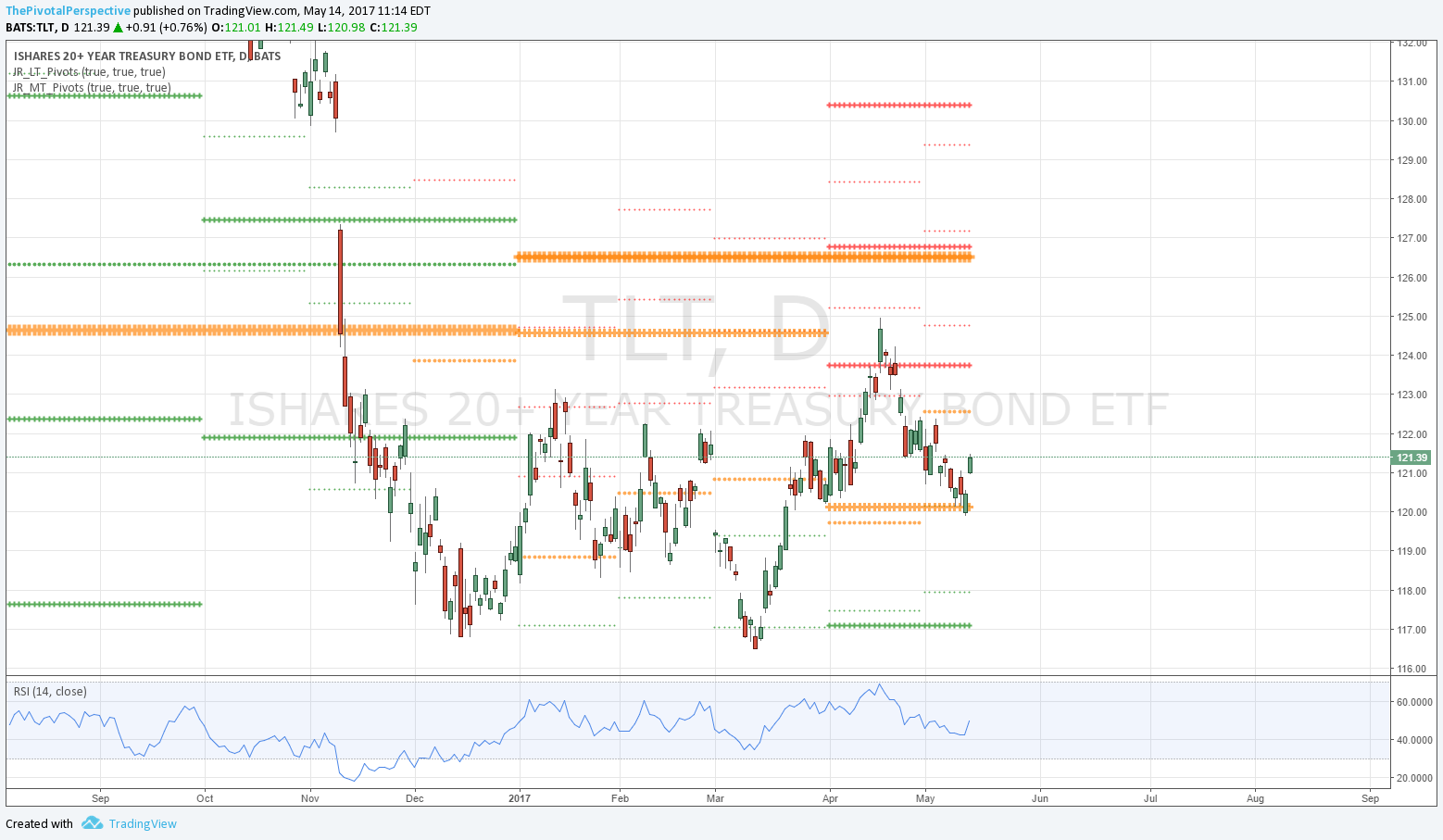

TLT

Weekly chart failed near the YP HP combo.

Daily chart holding Q2P again though, and back above rising D50.

TLT longer term weak, but just not giving up and staying above the Q2P which increases chance of bearish scenario for stocks.

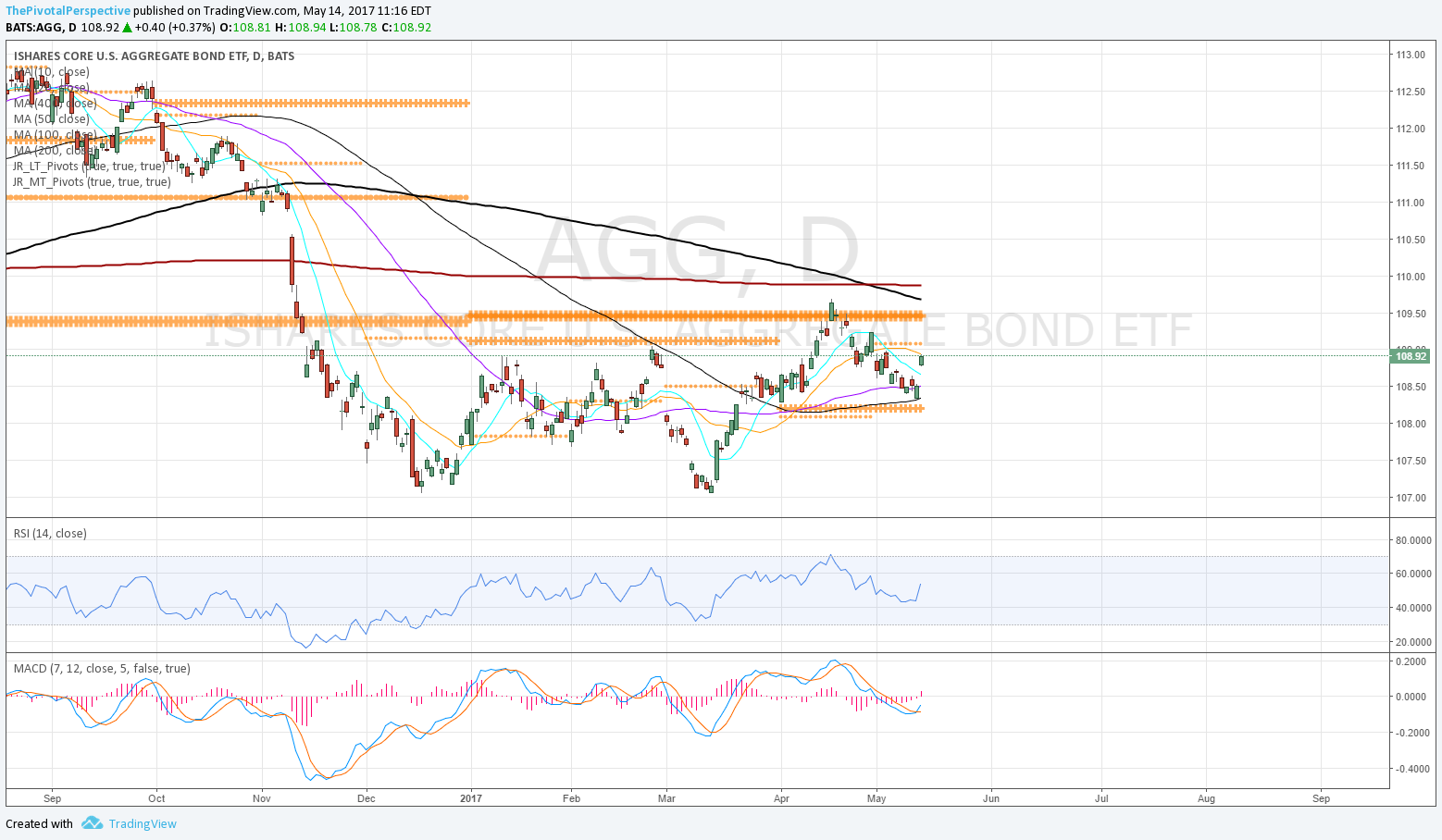

AGG

Also failed at YP / 1HP combo 4/18-20, but just held near test of Q2P and rising D100 and D50 MAs.

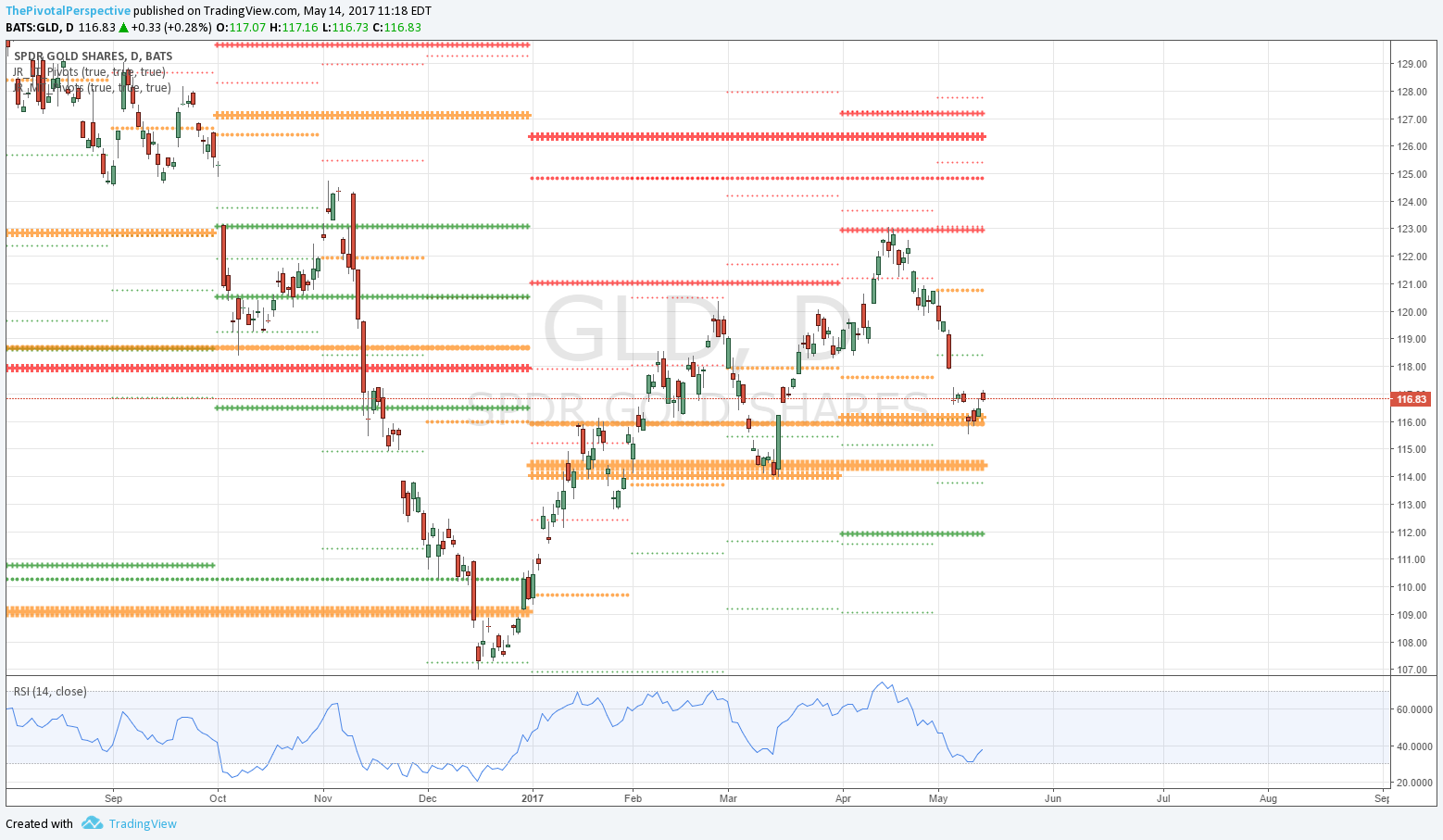

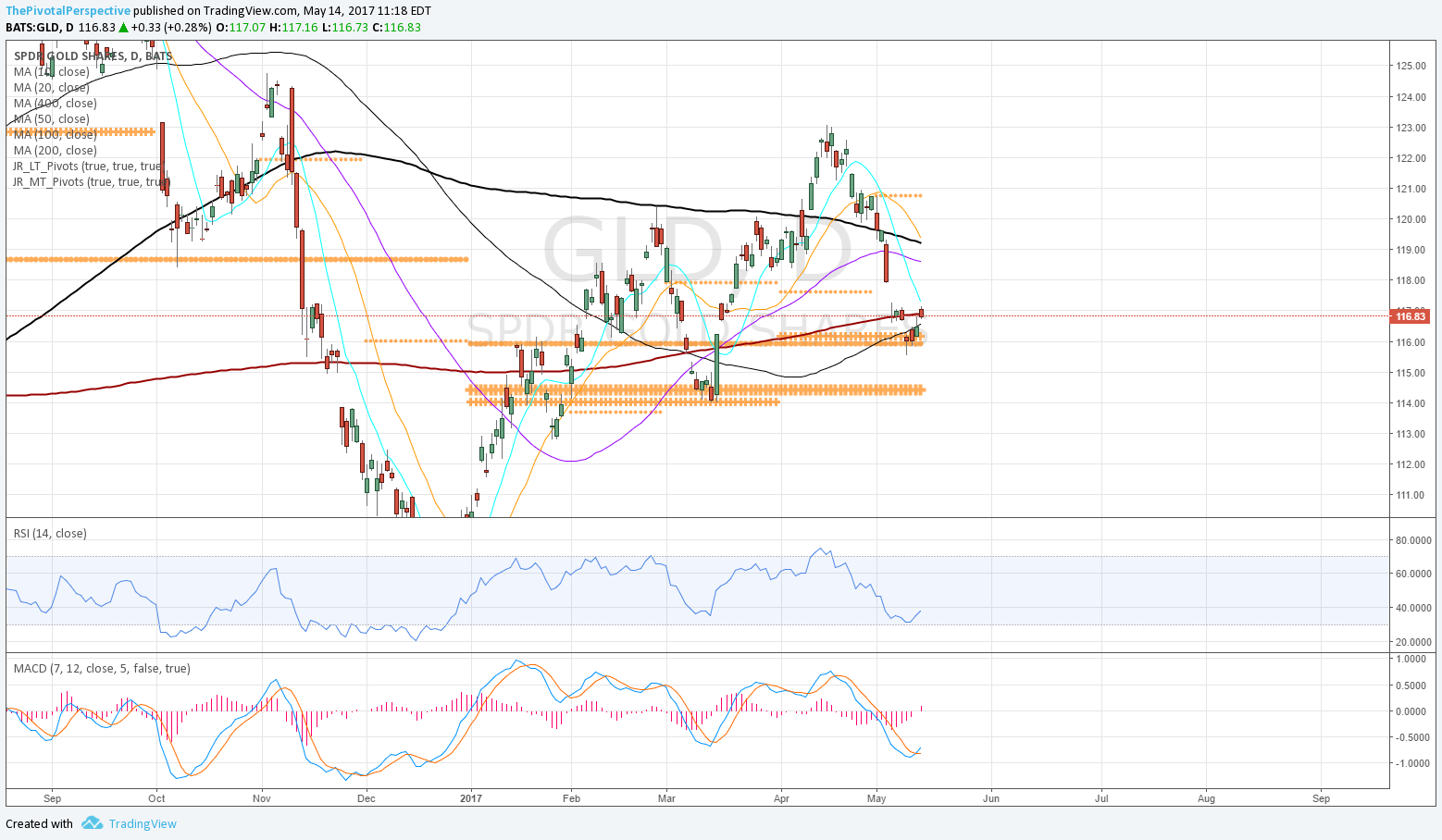

GLD

Weekly chart another hold of 1HP.

Daily top on Q2R1 and fast plunge. Again holding 1HP Q2P area.

MAs are tougher here, below sharply falling 10, falling 20, falling 50, and falling 200. Testing D400 (monthly 20MA) and rising 100 maybe helping out.

GDX

Reclaimed YP, but still under 1HP, Q2P and MayP. MAs mixed.